The South Kitsap Chamber of Commerce believes in keeping our members informed on important legislative issues that face local businesses. Navigating the governmental landscape can be very complicated and time-consuming. The Chamber relies on many partners to help us keep our membership educated.

Our goal is to provide our members with information and resources to make informed decisions that are happening on a Federal, State, and local level. Below are some of the bills we are currently tracking along with the write-ups provided by our advocacy partners.

Association of Washington Business Advocacy Resources

Governor Bill Action List Link to what the Governor has signed or vetoed

The Washington State Legislature has recessed for the 2023 season. There are hundreds of bills heading to the Governor’s desk for his signature. Check out the progress of the bills by clicking the link above.

2023 Legislative Session Bill Watch List

Below is a list of bills that were tracked during the 2023 Legislative Session

click “more” below

MoreThe South Kitsap Chamber of Commerce seeks to inform our members about legislation that may affect their businesses. We share from a number of different sources in order to give our members a broad perspective.

Thank you to our partners at the Association of Washington Businesses, the Washington Retail Association and the Washington Hospitality Association for all their hard work on keeping us informed and representing our interests.

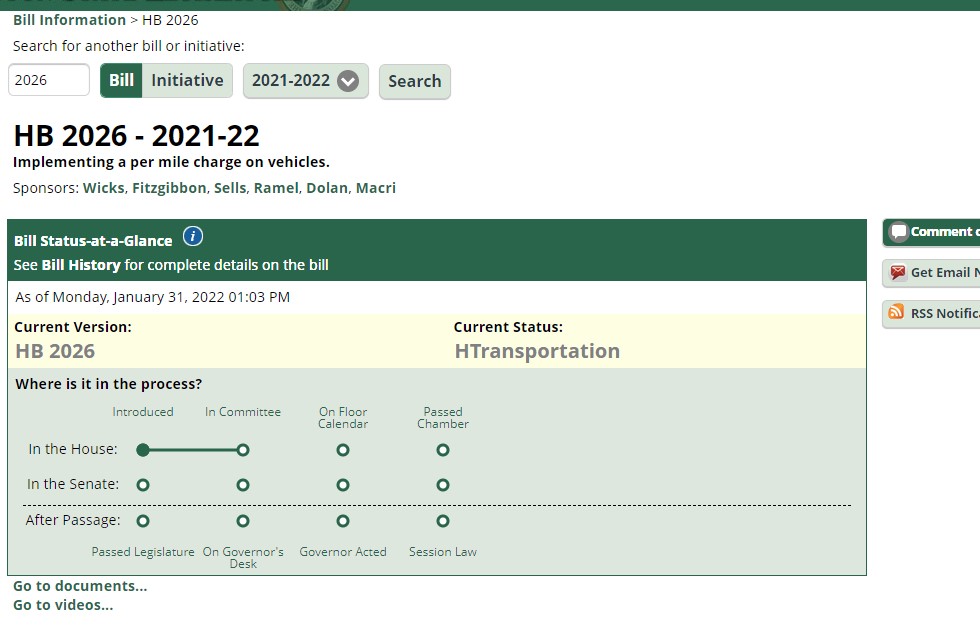

Tracking a bill in the Washington Legislature Get more information on a bill

Contacting Your Representative How to reach your district representative

State District 26

|

|

|

|

Representative

Michelle Caldier

(R)

Committees:

(360) 786 – 7802

|

Representative

Spencer Hutchins

(R)

Committees:

Health Care & Wellness

Transportation Housing (360) 786-7964

|

Senator

Emily Randall

(D)

Committees:

Higher Education & Workforce Development

Health & Long Term Care Transportation (360) 786 – 7650

|

State District 35

|

|

|

|

Representative

Travis Couture

(D)

Committees:

Human Services, Youth, & Early Learning

Appropriations

Capital Budget Environment & Energy (360) 786-7902

|

Representative

Dan Griffey

(R)

Committees:

Community Safety, Justice, & Reentry

Local Government Transportation (360) 786-7966

|

Senator

Drew MacEwen

(R) Committees:

Environment, Energy & Technology

Business, Financial Services, Gaming & Trade Labor & Commerce Transportation (360) 786-7902

|

2022 Legislative Review Representative voting record on key business issues

2022 Legislative session review

AWB highlights ‘the good, the bad & the ugly’ in the post-session legislative webinar. What passed the Legislature this year, what failed to pass, and how did lawmakers help or […]

Legislative Information Center Classes and Tutorials on navigating the Washington State Legislative Process

Understanding the Legislative Process

Understanding the Legislative Process (about 1 hr / Class Handout, Watch Online)This class is an in-depth view of the bi-cameral legislative system, how it is organized, and how a bill becomes law. The class […]

Navigating the Legislative Website

Navigating the Legislative Website (about 1 hr / Class Handout, Watch Online)This class provides an overview of navigating the Legislature’s website, includes information on what’s new to the website, and gives direction on […]

Advanced Legislative Website Use

Advanced Legislative Website Use (about 1 hr / Class Handout, Watch Online)This class is an in-depth course on use of the Legislature’s advanced features. It includes how to: Use Detailed Legislative Reports Set […]