Washington State Supplemental Budget review and highlights.

Washington State Supplemental Budget review and highlights.

Prepared by Association of Washington Business

The Senate Supplemental Budget is out. Below are some highlights. You can find the full details here: http://leap.leg.wa.gov/leap/budget/detail/2022/so2022Supp.asp

Summary of Chair Rolfes’ Budget Proposal

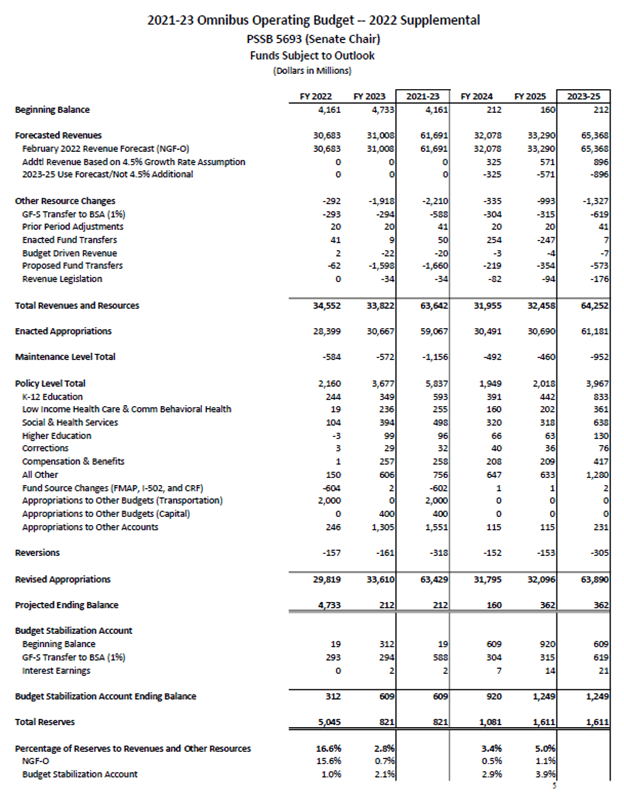

Chair Rolfes’ budget proposal is $63.7 billion NGF-O and $130.3 billion in total funds for the 2021-23 biennium, and $64.2 billion NGF-O and $117 billion in total funds for the 2023-25 biennium. In addition, Chair Rolfes proposes 11 bills that impact the near general fund. The

details of the budget proposal are discussed below and in the pages that follow.

The following list describes federal funds, spending items, savings items, appropriations into other accounts, and revenue changes that reflect the impact in the 2021-23 biennium:

Federal Funds

- $256 million for COVID-19 response in the public health system – diagnostic testing, case investigation, outbreak response, care coordination, and other activities

- $100 million for utility assistance, including grants to reduce or eliminate arrearages

- $94 million for a variety of solar energy infrastructure projects

- $82 million for electric vehicle charging infrastructure, fleet electrification, and planning

- $42 million for COVID-19 response in the Department of Corrections – health care costs, overtime usage, and building modification to support social distancing

- -$134 million from less-than-anticipated use of Pandemic Leave Assistance grants

Significant Spending Items

- $345 million to stabilize school districts that experienced enrollment declines

- $232 million for wage increases and other compensation changes for state employees

- $209 million for various salmon recovery projects across the state, including the Duckabush estuary restoration project

- $208 million to increase rates for vendors providing services to individuals with a developmental disability or with long-term care needs

- $199 million in total funds to extend the Medicaid transformation project for five years

- $172 million to address the physical and social emotional needs of students

- $125 million for reinvestment grants to communities disproportionately impacted by criminal laws and penalties for illegal drug sales, possession, and use

- $100 million to address workforce shortages and other challenges in behavioral health

- $95 million to increase rates for Working Connections Child Care, Behavioral Rehabilitation Services, Child Visitation, and Combined In-Home Services

- $93 million for costs associated with resentencing, as required under State v. Blake

- $75 million for the Farmers-to-Families Food Box Program

- $58 million for clients living in a shared living situation under the Liang settlement

- $41 million to transition encamped individuals from rights-of-way to permanent housing

- $38 million for expansions within the Aged, Blind, or Disabled program

- $29 million in total funds for projects within the Information Technology pool

- $29 million for nursing education and support within higher education

- $18 million for cybersecurity training programs within higher education

- $18 million for a benefit increase for eligible retirees of TRS1 and PERS1

- $17 million for investments in the Early Childhood Education & Assistance Program

Significant Savings Items

- $306 million in state savings from increased federal match for certain Medicaid services

- $274 million in state savings by utilizing federal funds for eligible services in the Department of Corrections and the Department of Social and Health Services

Appropriations and Transfers into Other Accounts

- $2 billion to support the transportation budget (Multimodal Account)

- $1.5 billion for emergency response (Washington Rescue Plan Transition Account)

- $500 million for IT projects (Strategic Enterprise Reserve Planning Technology Account)

- $400 million for seismic upgrades (School Seismic Safety Grant Account)

- $350 million for paid family leave (Paid Family Medical Leave Insurance Account)

- $217 million for legal expenses (Self-Insurance Liability Account)

- $100 million for salmon recovery efforts (Salmon Recovery Account)

- $30 million for cancer research (Andy Hill Cancer Research Endowment Account)

Major Revenue Changes

- $35 million from revisions to the Uniform Unclaimed Property Act

- -$17 million from modifications to the Washington Motion Picture Competitiveness Program

- -$16 million from a tax deduction for credit card processing companies

- -$16 million from stopping transfers from transportation accounts to the general fund

- -$11 million from extending the deferral period for sales and use taxes associated with the SR 520 bridge replacement and high occupancy vehicle project

The Four-Year Outlook

Chair Rolfes’ proposal, under the provisions of the four-year budget outlook (Chapter 8, Laws of 2012), is projected to end the 2023-25 biennium with $362 million in the projected ending fund balance and $1.6 billion in total reserves.